Health and sustainability market could be worth $25 billion to Australian producers by 2030

- Written by Katherine Wynn, Senior Economic Advisor, CSIRO

Growing interest in healthy and sustainable lifestyles could be worth about A$25 billion and make up about 10% of the value of Australia’s food and agribusiness sector by the end of next decade.

These projections are made by Australia’s industrial research agency, CSIRO, in an economic analysis published today[1].

The high rate of growth in demand for healthy and sustainable products could make the food and agribusiness sector more valuable than mining. The sector currently contributes about A$138 billion to the Australian economy, or about 7.6% of GDP, compared with 8% from mining.

Domestic demand will comprise about $15 billion. Exports of $10 billion will be underpinned by rising demand throughout Asia, where Australian produce already has a reputation for quality, safety and value.

Growth opportunities

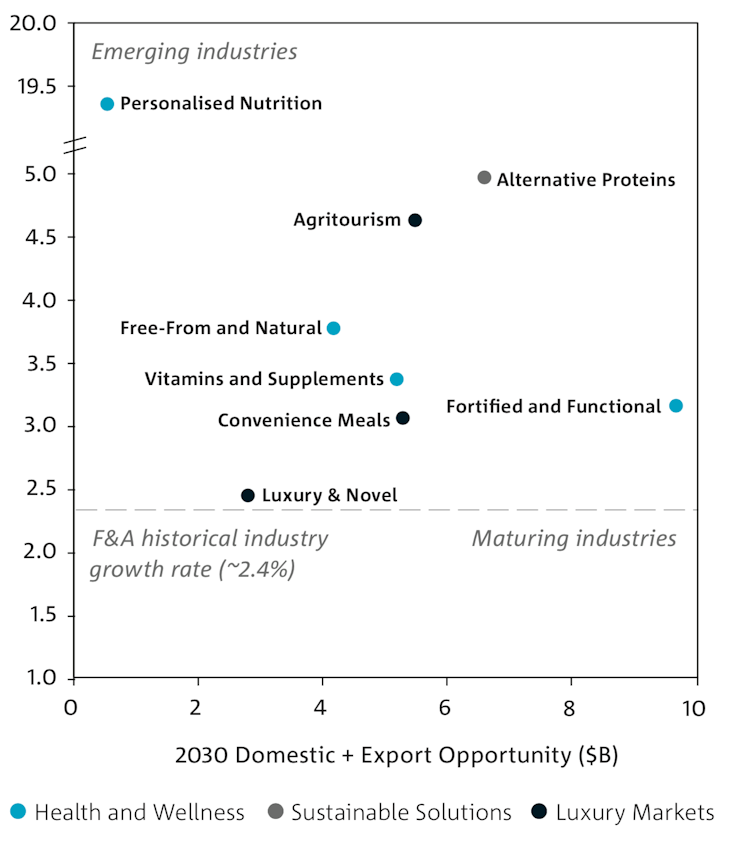

In health and wellness products, our report examines four high-growth opportunities:

- fortified and functional foods, which contain added ingredients intended to aid health

- free-from and natural products, including gluten-free and certified organic

- vitamins and supplements

- personalised nutrition.

In sustainable solutions, we identify three growth areas:

- alternative protein sources, any food eaten as an alternative to meat and seafood

- organic waste conversion, generating useful products from waste

- sustainable packaging, such as bioplastics and biodegradable packaging.

Read more: Beyond meat? The market for meat substitutes is way overdone[2]

As well as these areas relating to health and sustainability, we also look at three areas of “premium interactions” – products and services that attract premium prices due to quality, convenience, luxury or novel attributes, ranging from rock lobsters to gourmet cheeses and winery visits.

Estimating potential

This new economic analysis builds on CSIRO’s 2017 Food & Agribusiness roadmap[3]. It considers factors such as trends in consumer preferences, competitive advantages, potential competitors and substitutes, and broader macroeconomic forces such as population and income growth.

Because industry outlooks and projections are subject to high degrees of uncertainty, we have consciously included data sources, assumptions and methodology in the report. We welcome discussion of our assumptions and estimates.

The following figure shows the expected growth rate and potential size of the various market segments in 2030.

CSIRO, Growth opportunities for Australian food and agribusiness.

CSIRO, Growth opportunities for Australian food and agribusiness.

The biggest opportunity is in fortified and functional foods. Examples include probiotics and omega-3 oils added to yoghurt and milk, and antioxidant-rich breads, cereals and beverages.

Although this is a mature industry, CSIRO’s analysis suggests its value will increase from $6.7 billion in 2018 to $9.7 billion in 2030.

The second-biggest market potential is in alternative proteins. These include plant proteins such as soy and pea, and emerging products such as insect-based ingredients.

The market for alternative proteins is expected to grow at about 5% a year, more than double the rate of 2.4% for the whole food and agribusiness sector.

As well as domestic and export sales valued at $6.6 billion in 2030, we estimate alternative protein sources may be worth $5.4 billion in carbon emission and water savings. This estimate is based on first calculating the emissions and water saved by consuming alternatives to animal protein, and then calculating the value of those using market prices for carbon and water.

Read more: What's your beef? How 'carbon labels' can steer us towards environmentally friendly food choices[4]

We also see significant environmental savings from sustainable packaging ($1.7 billion) and organic waste conversion ($600 million).

Capturing market share depends, of course, on being able to compete with overseas suppliers. There is a risk, without investment in research, development and innovation, that Australia will not capture these opportunities. On the other hand, if we capitalise on our opportunities, the rewards could be even greater.

References

- ^ economic analysis published today (www.csiro.au)

- ^ Beyond meat? The market for meat substitutes is way overdone (theconversation.com)

- ^ Food & Agribusiness roadmap (www.csiro.au)

- ^ What's your beef? How 'carbon labels' can steer us towards environmentally friendly food choices (theconversation.com)

Authors: Katherine Wynn, Senior Economic Advisor, CSIRO