Small, but well-formed. The new home deposit scheme will help, and it's unlikely to push up prices

- Written by Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University

The new First Home Loan Deposit Scheme[1] announced the Coalition, and instantly backed by Labor[2], is likely to be popular among those on the cusp of buying their first home.

It’ll be open to singles earning up to A$125,000 and couples earning up to A$200,000 who have saved at least 5% of the value of the home. The government-owned National Housing Finance and Investment Corporation will partner with private lenders to put up as much as another 15% of the value of the home to take the deposit to 20%.

However, the scheme is capped at 10,000 home buyers per year[3], roughly one tenth of the number of Australians who bought first homes in 2018.

It’ll help them - the latest survey shows that more than half of first homebuyers[4] needed financial assistance outside of their own savings to get their deposit. The benefits of home ownership[5] have been widely documented. But will it do enough?

Source of deposits

Authors' own calculations from ABS Survey of Income and Housing 2013-14[6]

An often-expressed concern is that such a scheme will bid up house prices[7]. However, it is means-tested, making it much less vunerable to this criticism than the non-means-tested First Home Owners’ Grant[8].

And is also capped at 10,000 loans per year, giving it little scope to price pressure.

However, it may not be means-tested enough.

Consider the population subgroup that broadly comprises aspiring homebuyers who qualify for the scheme: renters aged 25-34 years who meet the scheme’s income criteria and whose financial wealth is between 5% and 20% of the lowest-priced quarter of houses for sale in the borad area in which they live.

In the most-recent 2015 ABS Survey of Income and Housing[9] there were 127,000 such potential eligible first home buyers, more than 12 times the 10,000 cap.

Read more:

That election promise. It will help first home buyers, but they better be cautious[10]

The cap is a practical necessity of course, needed to limit impacts on prices and prevent a cost blowout. But the weakness of the scheme is that the cap will be filled on a “first come, first serve[11]” basis, without distinguishing between those who actually need help and those who are likely to meet the deposit requirement anyway.

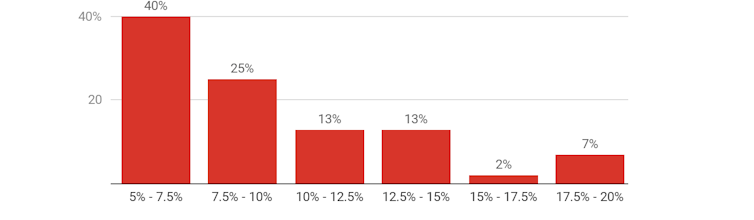

The graph shows that some 40% of potential first home buyers have managed to save a deposit amounting to not much more than 5% of the home value. Only 7% have a 20% deposit or something near it.

Potential users of the scheme, by amount of deposit saved

Authors' own calculations from ABS Survey of Income and Housing 2013-14[6]

An often-expressed concern is that such a scheme will bid up house prices[7]. However, it is means-tested, making it much less vunerable to this criticism than the non-means-tested First Home Owners’ Grant[8].

And is also capped at 10,000 loans per year, giving it little scope to price pressure.

However, it may not be means-tested enough.

Consider the population subgroup that broadly comprises aspiring homebuyers who qualify for the scheme: renters aged 25-34 years who meet the scheme’s income criteria and whose financial wealth is between 5% and 20% of the lowest-priced quarter of houses for sale in the borad area in which they live.

In the most-recent 2015 ABS Survey of Income and Housing[9] there were 127,000 such potential eligible first home buyers, more than 12 times the 10,000 cap.

Read more:

That election promise. It will help first home buyers, but they better be cautious[10]

The cap is a practical necessity of course, needed to limit impacts on prices and prevent a cost blowout. But the weakness of the scheme is that the cap will be filled on a “first come, first serve[11]” basis, without distinguishing between those who actually need help and those who are likely to meet the deposit requirement anyway.

The graph shows that some 40% of potential first home buyers have managed to save a deposit amounting to not much more than 5% of the home value. Only 7% have a 20% deposit or something near it.

Potential users of the scheme, by amount of deposit saved

Deposit saved by renters aged 25-34 who meet the scheme’s eligibility criteria, per cent of lower quartile property prices in area of residence, 2015-16.

Authors' own calculations from the ABS Survey of Income and Housing 2015-16[12]

The Coalition (or Labor) could get more bang for its buck within the cap by targeting those in greater need of assistance; for example by prioritising those who cannot access the so-called Bank of Mum and Dad[13]. Not everyone has access to wealthy parents.

The Great Australian Dream of owning a home has been fading fast, and not just for young people. Naturally, the scheme’s details of the scheme require scrutiny. But overall, it provides a welcome acknowledgement (by both major parties) that the affordability crisis facing young people has not waned despite recent house price declines.

Read more:

The brutal truth on housing. Someone has to lose in order for first homebuyers to win[14]

The scheme will restore the opportunity – at least to some – to accumulate wealth in property and enjoy the security and other benefits[15] that home ownership brings.

But seriously addressing housing affordability will ultimately require a bigger intervention.

Deposit saved by renters aged 25-34 who meet the scheme’s eligibility criteria, per cent of lower quartile property prices in area of residence, 2015-16.

Authors' own calculations from the ABS Survey of Income and Housing 2015-16[12]

The Coalition (or Labor) could get more bang for its buck within the cap by targeting those in greater need of assistance; for example by prioritising those who cannot access the so-called Bank of Mum and Dad[13]. Not everyone has access to wealthy parents.

The Great Australian Dream of owning a home has been fading fast, and not just for young people. Naturally, the scheme’s details of the scheme require scrutiny. But overall, it provides a welcome acknowledgement (by both major parties) that the affordability crisis facing young people has not waned despite recent house price declines.

Read more:

The brutal truth on housing. Someone has to lose in order for first homebuyers to win[14]

The scheme will restore the opportunity – at least to some – to accumulate wealth in property and enjoy the security and other benefits[15] that home ownership brings.

But seriously addressing housing affordability will ultimately require a bigger intervention.

References

- ^ First Home Loan Deposit Scheme (www.liberal.org.au)

- ^ instantly backed by Labor (theconversation.com)

- ^ 10,000 home buyers per year (www.smh.com.au)

- ^ more than half of first homebuyers (www.abs.gov.au)

- ^ benefits of home ownership (www.tandfonline.com)

- ^ Authors' own calculations from ABS Survey of Income and Housing 2013-14 (www.abs.gov.au)

- ^ bid up house prices (www.theguardian.com)

- ^ First Home Owners’ Grant (www.aph.gov.au)

- ^ 2015 ABS Survey of Income and Housing (www.abs.gov.au)

- ^ That election promise. It will help first home buyers, but they better be cautious (theconversation.com)

- ^ first come, first serve (www.smh.com.au)

- ^ Authors' own calculations from the ABS Survey of Income and Housing 2015-16 (www.abs.gov.au)

- ^ Bank of Mum and Dad (theconversation.com)

- ^ The brutal truth on housing. Someone has to lose in order for first homebuyers to win (theconversation.com)

- ^ security and other benefits (www.tandfonline.com)

Authors: Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University