Budget 2019 at a glance

- Written by Emil Jeyaratnam, Data + Interactives Editor, The Conversation

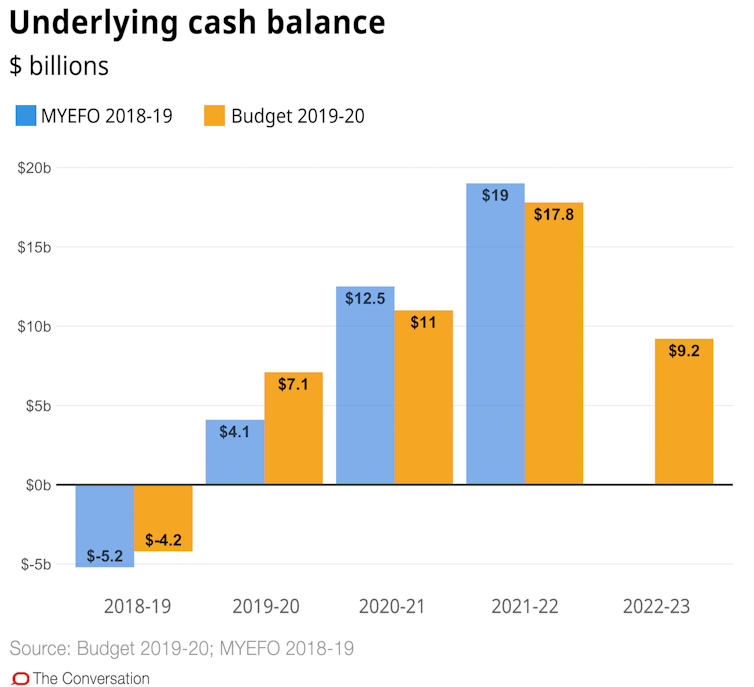

The budget bottom line will surge to a surplus next financial year on the back of higher than expected revenues from commodities, strong corporate profits and low unemployment.

The estimated surplus of A$7.1 billion for 2019-20 will be the first time the budget has entered positive territory since 2007-08.

Read more:

Iron ore dollars repurposed to keep the economy afloat in Budget 2019[1]

How will the government spend this unexpected windfall of revenues?

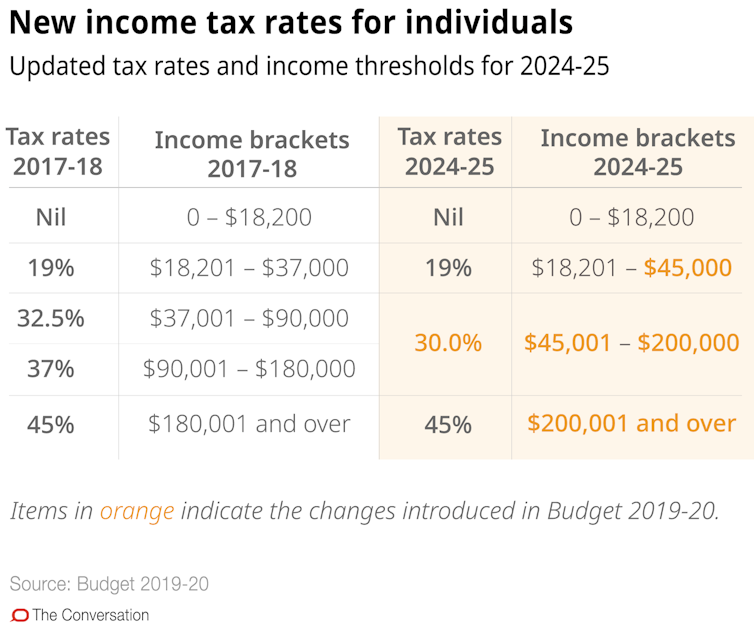

Simplifying the tax system will cost the government $158 billion over the next ten years. The measures include:

doubling the low and middle income tax offset from $530 to up to $1,080 for people earning up to $126,000, starting from the current 2018-19 financial year

changing the 32.5% threshold to be $45,001 to $120,000 from 2022-23, with the 19% bracket covering incomes from the tax-free threshold up to $45,000

reducing the 32.5% tax rate to 30% from 2024-25 onwards, and changing the income thresholds so that the 30% rate applies to all earners from $45,000 to $200,000

removal of the 37% rate altogether from 2024-25.

Read more:

View from The Hill: budget tax-upmanship as we head towards polling day[2]

Read more:

Iron ore dollars repurposed to keep the economy afloat in Budget 2019[1]

How will the government spend this unexpected windfall of revenues?

Simplifying the tax system will cost the government $158 billion over the next ten years. The measures include:

doubling the low and middle income tax offset from $530 to up to $1,080 for people earning up to $126,000, starting from the current 2018-19 financial year

changing the 32.5% threshold to be $45,001 to $120,000 from 2022-23, with the 19% bracket covering incomes from the tax-free threshold up to $45,000

reducing the 32.5% tax rate to 30% from 2024-25 onwards, and changing the income thresholds so that the 30% rate applies to all earners from $45,000 to $200,000

removal of the 37% rate altogether from 2024-25.

Read more:

View from The Hill: budget tax-upmanship as we head towards polling day[2]

Other major cuts and spending items are listed below.

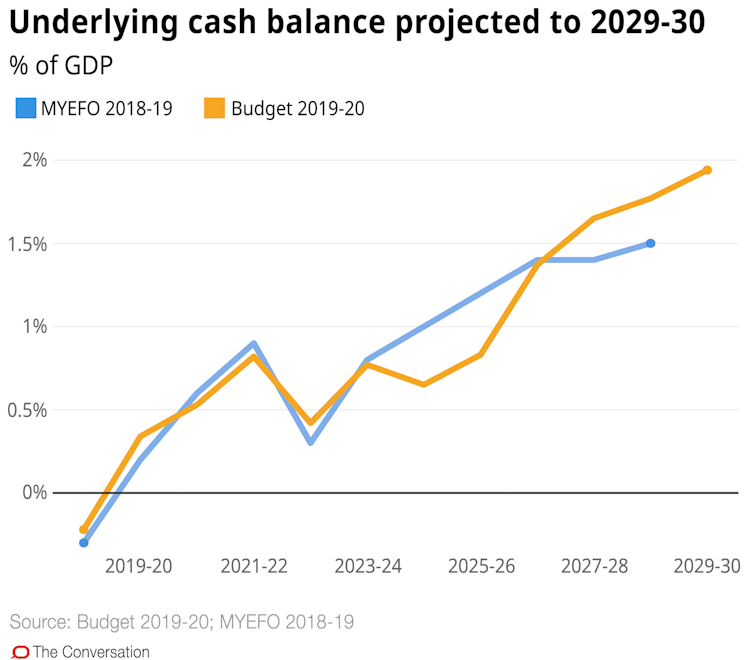

Despite the boost in revenue the government expects to reach its long-term target of surplus being 1% of gross domestic product later than estimated in the December budget update[3].

The government now expects surplus to exceed 1% of GDP in 2026-27.

Other major cuts and spending items are listed below.

Despite the boost in revenue the government expects to reach its long-term target of surplus being 1% of gross domestic product later than estimated in the December budget update[3].

The government now expects surplus to exceed 1% of GDP in 2026-27.

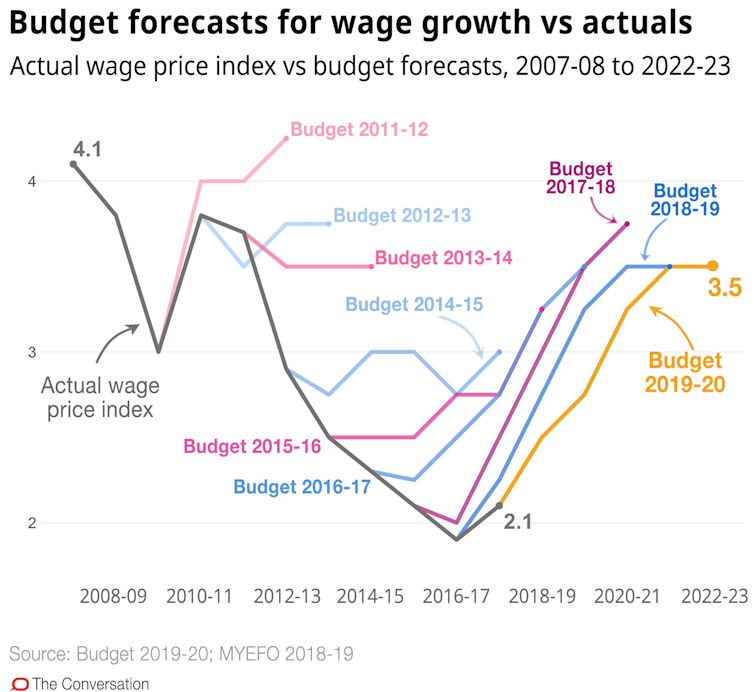

This budget, like many before it, predicts wages to increase over the next four years. The government expects the wage price index to increase from its current 2.1 to 3.5 by 2022-23.

This budget, like many before it, predicts wages to increase over the next four years. The government expects the wage price index to increase from its current 2.1 to 3.5 by 2022-23.

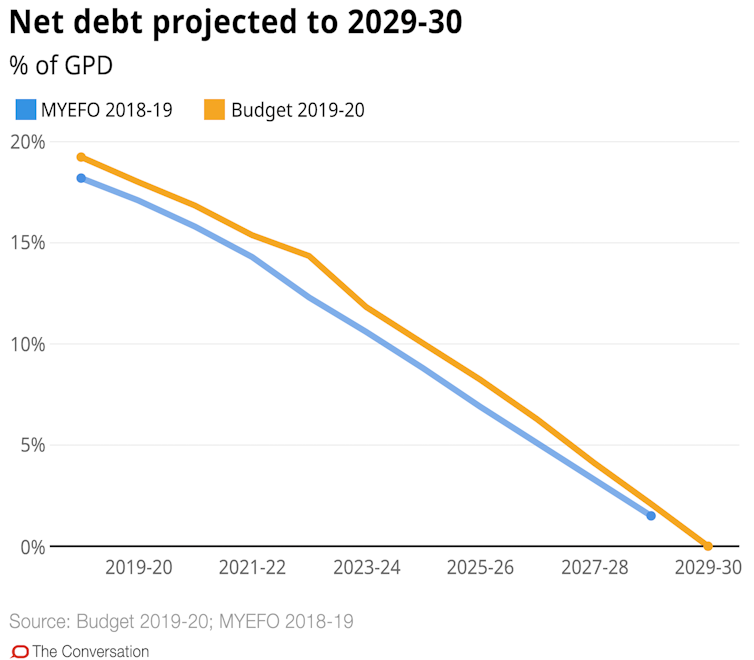

Net debt as a share of the economy is expected to peak in 2018-19 (19.2% of GDP), and will then commence a downward trend until fully eliminated in 2029-30.

Read more:

Frydenberg’s budget looks toward zero net debt, but should this be our aim?[4]

Net debt as a share of the economy is expected to peak in 2018-19 (19.2% of GDP), and will then commence a downward trend until fully eliminated in 2029-30.

Read more:

Frydenberg’s budget looks toward zero net debt, but should this be our aim?[4]

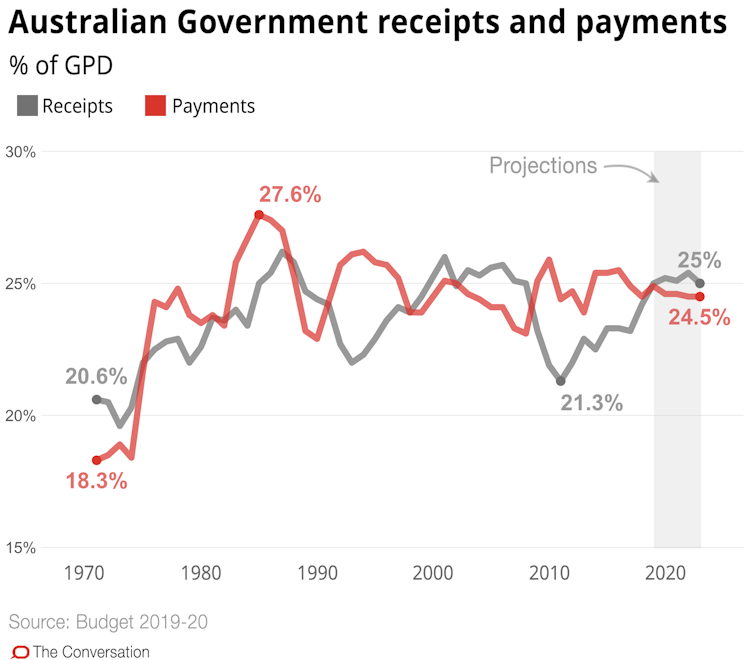

Government receipts are expected to climb from 24.2% of GDP in 2017-18 to 25% by 2022-23. Payments are expected to be 24.5% of GDP in 2022-23.

Government receipts are expected to climb from 24.2% of GDP in 2017-18 to 25% by 2022-23. Payments are expected to be 24.5% of GDP in 2022-23.

References

- ^ Iron ore dollars repurposed to keep the economy afloat in Budget 2019 (theconversation.com)

- ^ View from The Hill: budget tax-upmanship as we head towards polling day (theconversation.com)

- ^ December budget update (theconversation.com)

- ^ Frydenberg’s budget looks toward zero net debt, but should this be our aim? (theconversation.com)

Authors: Emil Jeyaratnam, Data + Interactives Editor, The Conversation

Read more http://theconversation.com/infographic-budget-2019-at-a-glance-114289