It’s the budget cash splash that reaches back in time

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Talk about retrospective. In his determination to quickly inject money into the economy (for economic as well as political reasons), Treasurer Josh Frydenberg has reached back in time to give us an extra tax cut on income already earned during the financial year that’s about to finish.

Almost a year ago, in May 2018, Frydenberg’s predecessor, Scott Morrison, promised a “sort-of” tax cut for the financial year beginning in July 2018. People earning between A$48,000 and A$90,000 would get a tax offset – a bonus – of $530 as part of their tax return.

People earning more, or less, would get lesser amounts but would still get something, right up to a cutoff of $125,333.

The arrangement meant they wouldn’t get the money until the following financial year, the one beginning this July, after they submitted their tax forms.

Labor trumped him within days, announcing a bigger offset[1] in its budget reply speech.

Not only bigger, but backdated

Now Frydenberg has trumped Labor and Morrison, announcing a rebate of almost twice the original size — $1,080 — to be paid out after the end of the financial year.

But, in an innovative piece of policy, he is applying the increased offset to the financial year that’s almost over, as well as the ones to come. It means that after submitting their tax forms for the financial year that’s about to end, most Australians will get $1,080 back for the work they did during 2018-19, instead of the $530 that was promised at the time (assuming the measure is enacted).

It will work the same way as the Rudd government’s “cash splash” during the global financial crisis. It’ll be paid into bank accounts within weeks, providing near-instant, much-needed spending power.

The fact that it will be bigger than the first Rudd government cash splash (which was $800 for qualifying taxpayers) is probably no bad thing.

It’s what we need, unfortunately

Consumer spending is much weaker than was expected in the December budget update just five months ago, and a lot weaker than was expected in Morrison’s last budget as treasurer a year ago.

Morrison expected consumer spending to climb 2.75% for 2018-19. Frydenberg cut that forecast to 2.5% in December and to 2.25% today.

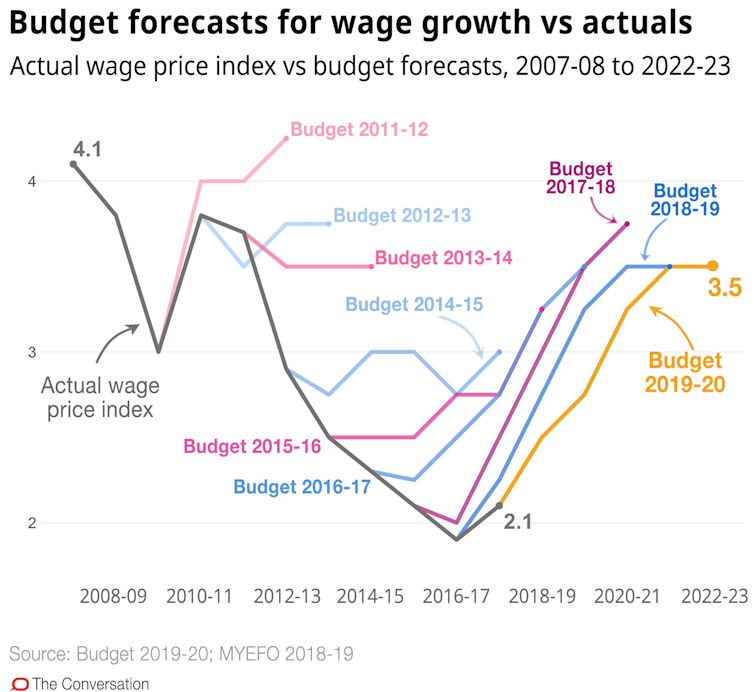

Morrison expected consumer spending to climb 3% in 2019-20, and Frydenberg held the line in December. Now he has marked down the 2019-20 forecast to 2.75%. He has also marked down (yet again) the forecasts for wage growth and economic growth.

Home prices, not explicitly forecast in the budget, are also lower than was expected in the last budget and budget update. Along with lower-than-expected wage growth, this is depressing consumer spending.

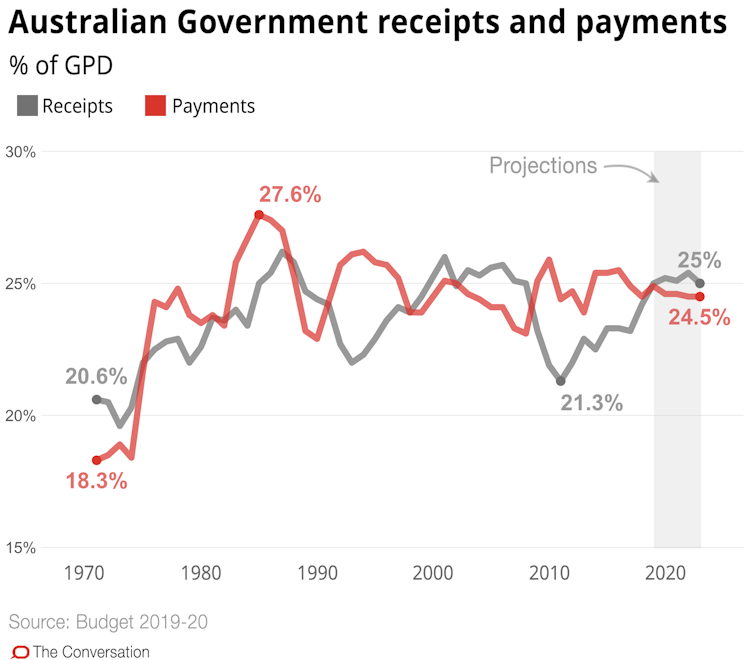

The markdowns in spending, wage growth and economic growth have started to hurt revenue forecasts, but the damage isn’t yet apparent because at the same time dramatically higher iron ore prices have been pouring more money into the budget than was expected.

When iron ore prices fall, we’ll be exposed

When, for whatever reason, the higher iron ore prices recede (and that’s what the Treasury says it is expecting), the budget will look much worse. Unless consumer spending and wages pick up, which is also what the Treasury says it is expecting, in the face of evidence to the contrary.

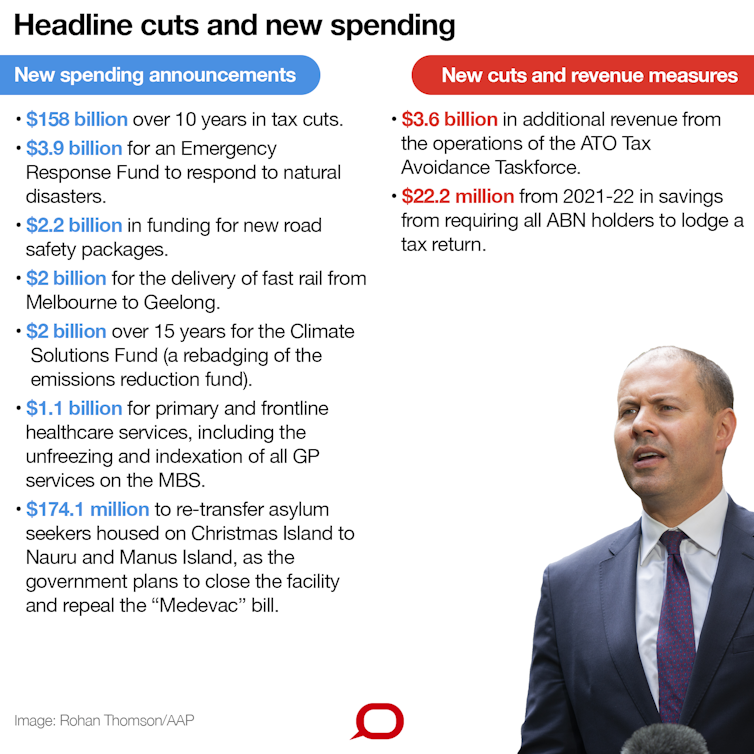

That’s what makes Frydenberg’s cash splash so important. It will push an extra $3.5 billion into the economy within weeks. On top of it will be an extended instant asset write-off for small and medium-sized businesses, the operative word being “instant”.

From now on, businesses with a turnover of up to $50 million (up from $10 million) will be able to buy equipment worth up to $30,000 (previously $25,000) and deduct the full cost from the tax they will owe from July.

Read more:

Iron ore dollars repurposed to keep the economy afloat in Budget 2019[2]

The measure won’t cost the government money until next financial year, but it will inject money into the economy from Wednesday in the nine weeks before that financial year starts, as as many as 22,000 previously ineligible businesses spend up to $30,000 on equipment (even cars) and then spend it again and again without limit.

A peculiarity of the instant asset write-off is that businesses can spend as much as they like and get it all back, as long as it is broken up into parcels of less than $30,000. In an example quoted in the budget papers, a previously ineligible food manufacturing business buys ten new commercial ovens, each for $12,000. The entire $120,000 can be written off within weeks, helping the business “invest, grow, and employ more workers”.

Home prices, not explicitly forecast in the budget, are also lower than was expected in the last budget and budget update. Along with lower-than-expected wage growth, this is depressing consumer spending.

The markdowns in spending, wage growth and economic growth have started to hurt revenue forecasts, but the damage isn’t yet apparent because at the same time dramatically higher iron ore prices have been pouring more money into the budget than was expected.

When iron ore prices fall, we’ll be exposed

When, for whatever reason, the higher iron ore prices recede (and that’s what the Treasury says it is expecting), the budget will look much worse. Unless consumer spending and wages pick up, which is also what the Treasury says it is expecting, in the face of evidence to the contrary.

That’s what makes Frydenberg’s cash splash so important. It will push an extra $3.5 billion into the economy within weeks. On top of it will be an extended instant asset write-off for small and medium-sized businesses, the operative word being “instant”.

From now on, businesses with a turnover of up to $50 million (up from $10 million) will be able to buy equipment worth up to $30,000 (previously $25,000) and deduct the full cost from the tax they will owe from July.

Read more:

Iron ore dollars repurposed to keep the economy afloat in Budget 2019[2]

The measure won’t cost the government money until next financial year, but it will inject money into the economy from Wednesday in the nine weeks before that financial year starts, as as many as 22,000 previously ineligible businesses spend up to $30,000 on equipment (even cars) and then spend it again and again without limit.

A peculiarity of the instant asset write-off is that businesses can spend as much as they like and get it all back, as long as it is broken up into parcels of less than $30,000. In an example quoted in the budget papers, a previously ineligible food manufacturing business buys ten new commercial ovens, each for $12,000. The entire $120,000 can be written off within weeks, helping the business “invest, grow, and employ more workers”.

Frydenberg would probably prefer it if the measures weren’t called “stimulus” measures, but that’s what they are. And they are needed, for economic reasons as well as for political ones.

The economists surveyed in January for this year’s Conversation economic survey[3] assigned a 25% probability to a recession within the next two years. The downward revisions in the budget have done nothing to change that assessment.

The government elected in May will inherit a fragile economy in need of help.

Frydenberg has demonstrated that he is just as prepared as was Kevin Rudd during the global financial crisis to provide it.

Frydenberg would probably prefer it if the measures weren’t called “stimulus” measures, but that’s what they are. And they are needed, for economic reasons as well as for political ones.

The economists surveyed in January for this year’s Conversation economic survey[3] assigned a 25% probability to a recession within the next two years. The downward revisions in the budget have done nothing to change that assessment.

The government elected in May will inherit a fragile economy in need of help.

Frydenberg has demonstrated that he is just as prepared as was Kevin Rudd during the global financial crisis to provide it.

The Conversation

The Conversation

References

- ^ announcing a bigger offset (theconversation.com)

- ^ Iron ore dollars repurposed to keep the economy afloat in Budget 2019 (theconversation.com)

- ^ Conversation economic survey (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Read more http://theconversation.com/its-the-budget-cash-splash-that-reaches-back-in-time-114188