Why rents, not property prices, are best to assess housing supply and need-driven demand

- Written by Rachel Ong, Professor of Economics, School of Economics and Finance, Curtin University

If property prices are rising, it is commonly assumed we must be facing a shortage of supply relative to demand[1]. So if we’re ever going to reduce housing affordability problems, we’re simply going to have to build our way out of it[2]. After all, as anyone who’s sat in an introductory economics class would tell you, basic economics is sufficient to at least suggest that if prices are rising in the long term, then supply must be lagging behind demand.

It’s true the housing market is largely subject to the forces of supply and demand. The deficiency of this argument lies, not so much in any perceived cracks in the supply-demand framework taught in Economics 101, but in the fact that the appropriate “price” indicator is not property prices. It’s rent.

What’s the ‘price’ of housing?

The problem with relying on rising property prices as a “price” signal of a supply shortage is that the dwelling an owner-occupier buys is both a consumption and an investment good. It offers a place to live as well as an asset in which the owner invests a substantial part of their wealth. Hence, property prices are at best a murky indicator of the balance of supply and demand for housing as a home to live in and an asset to own.

It is well established in the housing economics literature[3] that the “price” signal for the adequacy of supply relative to demand for housing services is rent. Rent reflects the cost of consuming housing or, to put it another way, the cost of living in a home. So if housing supply is lagging behind demand for housing as a place to live in, we should expect to see rents rise.

Are rents keeping pace with property prices?

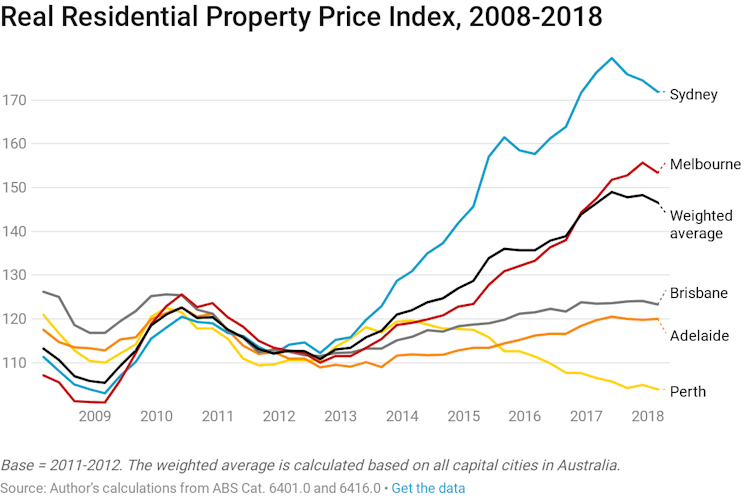

Property prices have clearly surged over the long term in Australia, as the chart below shows.

The Residential Property Price Index (RPPI[4]), adjusted for inflation and averaged across all capital cities, climbed by nearly 30% from 2008-18. Property prices in Sydney and Melbourne, where the real RPPI surged by 54% and 43% respectively, largely drove this average increase.

But housing economics principles tell us this can only be attributed to a supply shortage if rents have also soared.

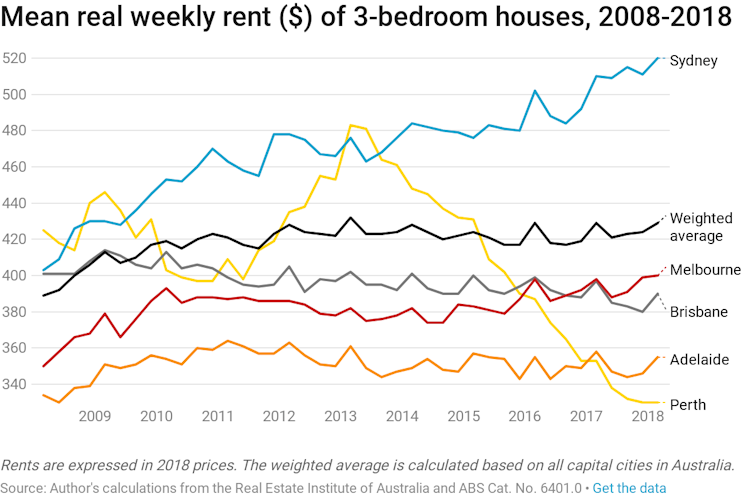

It turns out real rents have remained relatively flat in most capital cities over the last decade. The chart below shows the real weekly rent of three-bedroom houses across all capital cities over the past decade. The weighted average has shifted upwards by a mere 10%, from $389 to $429.

The Residential Property Price Index (RPPI[4]), adjusted for inflation and averaged across all capital cities, climbed by nearly 30% from 2008-18. Property prices in Sydney and Melbourne, where the real RPPI surged by 54% and 43% respectively, largely drove this average increase.

But housing economics principles tell us this can only be attributed to a supply shortage if rents have also soared.

It turns out real rents have remained relatively flat in most capital cities over the last decade. The chart below shows the real weekly rent of three-bedroom houses across all capital cities over the past decade. The weighted average has shifted upwards by a mere 10%, from $389 to $429.

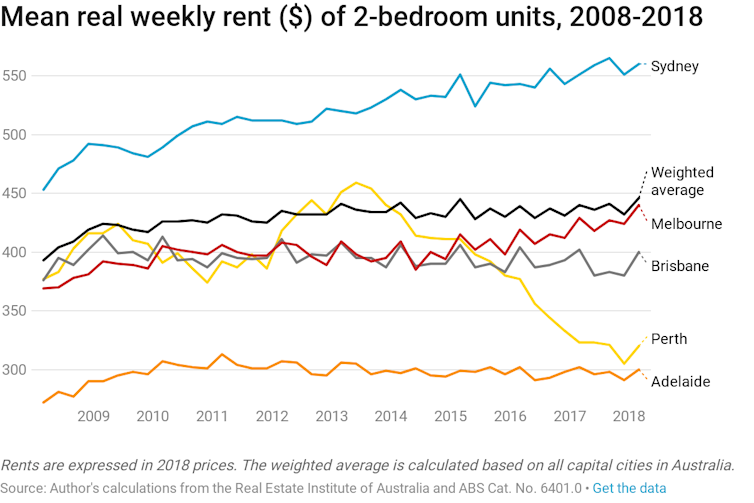

For two-bedroom units, the average real weekly rent has also shifted slightly from $393 to $446. That’s a mild 13% increase over a decade.

For two-bedroom units, the average real weekly rent has also shifted slightly from $393 to $446. That’s a mild 13% increase over a decade.

The real rent increases have been relatively minor compared to the nearly 30% surge in real RPPI across all capital cities. There are again some differences between cities, but only Sydney had a noticeable increase in real rents. This still lagged behind the spike in real RPPI in the city.

Dealing with the crux of the affordability crisis

Overall, rent increases are clearly not keeping pace with soaring property prices in all major capital cities in Australia. So claims[5] that a housing shortage is the principal cause of a lack of affordable housing are unfounded. Supply-side solutions, while important, will need to be targeted directly at low-income groups[6] who find it difficult to compete in private rental markets to meet housing needs.

On the other hand, successive governments have offered preferential tax treatments of housing assets. These have encouraged a significant build-up of wealth in housing assets.

Some of these favourable tax advantages have undoubtedly been capitalised into rising property prices. That has made it harder and harder for renters to break into the home ownership market.

These are structural problems embedded within our tax policy settings. Hence, their impacts on house prices will not magically disappear any time soon unless policymakers are willing to undertake meaningful tax reform[7] that shifts the emphasis away from treating housing as a commodity back to affordable housing as a fundamental right of all Australians.

The real rent increases have been relatively minor compared to the nearly 30% surge in real RPPI across all capital cities. There are again some differences between cities, but only Sydney had a noticeable increase in real rents. This still lagged behind the spike in real RPPI in the city.

Dealing with the crux of the affordability crisis

Overall, rent increases are clearly not keeping pace with soaring property prices in all major capital cities in Australia. So claims[5] that a housing shortage is the principal cause of a lack of affordable housing are unfounded. Supply-side solutions, while important, will need to be targeted directly at low-income groups[6] who find it difficult to compete in private rental markets to meet housing needs.

On the other hand, successive governments have offered preferential tax treatments of housing assets. These have encouraged a significant build-up of wealth in housing assets.

Some of these favourable tax advantages have undoubtedly been capitalised into rising property prices. That has made it harder and harder for renters to break into the home ownership market.

These are structural problems embedded within our tax policy settings. Hence, their impacts on house prices will not magically disappear any time soon unless policymakers are willing to undertake meaningful tax reform[7] that shifts the emphasis away from treating housing as a commodity back to affordable housing as a fundamental right of all Australians.

References

- ^ assumed we must be facing a shortage of supply relative to demand (www.aph.gov.au)

- ^ build our way out of it (www.theguardian.com)

- ^ housing economics literature (www.jstor.org)

- ^ RPPI (www.abs.gov.au)

- ^ claims (sjm.ministers.treasury.gov.au)

- ^ targeted directly at low-income groups (theconversation.com)

- ^ meaningful tax reform (www.ahuri.edu.au)

Authors: Rachel Ong, Professor of Economics, School of Economics and Finance, Curtin University